This article was originally posted on the Street Insight section of thestreet.com on 4/25/2006 7:09 AM EST

The media have been harping about its business in China and claiming that the firm has weak corporate governance.

This is nonsense and overlooks some smart moves.

Remember, Google's foes have their own reasons to bash it.

Remember, Google's foes have their own reasons to bash it.

What can I say about Google (GOOG) that hasn't been said? Just this: Google is a stellar example of a socially responsible company. Before you remind me that the firm has sided with a supposedly repressive regime in China, let me point out a few facts.

Happy Shareholders and Stakeholders

The company makes the world a better place: It is environmentally friendly, it has significant minority and women representation at all levels, and it is doing very well financially. As Scott Rothbort pointed out in his earnings summary, first-quarter earnings were a blowout by any measure. The firm had revenue growth of 80%, and EPS of $1.95 a share blew away analysts' earnings estimates. In fact, without expensing stock options under new accounting rules, EPS would have been 17% higher.

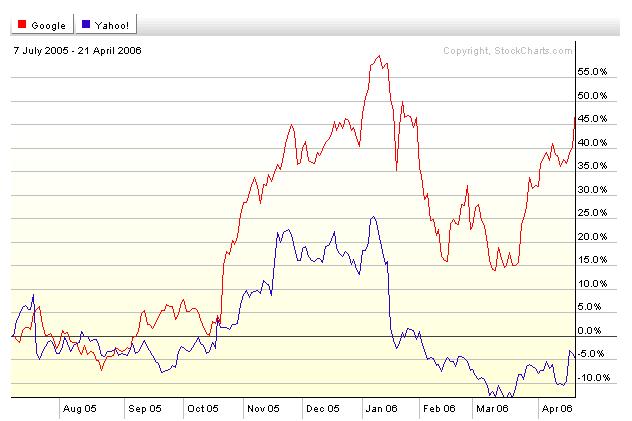

Google is also beating the pants off its main competitor, Yahoo! (YHOO), and the stock price reflects it. This is a stellar performance no matter how you slice it, so what more could a socially responsible investor want?

GOOG and YHOO (July 7, 2005 to April 21, 2006)

Google and Yahoo!

Source: StockCharts.com

Source: StockCharts.com

Guess Who Didn't Like Google's IPO?

Much has been made of supposedly weak corporate governance at Google. This is nonsense. The company has directly threatened the monopoly that the major investment banks have on the IPO market. Google sought to sell shares directly to investors via the Internet, and this had to be stopped. The SEC put a quick end to this plan (essentially working on behalf of the investment banks it is supposed to regulate). All "corporate governance issues" arise from this source. And that is all there is to this.

Smart Move to Protect Privacy

Google's decision to "withhold millions of online search records from the U.S. Department of Justice" looks better and better each day. This is especially true in light of reports that recently signed secret orders authorized the National Security Agency to eavesdrop on U.S. citizens and foreign nationals in the United States. Imagine the legal liability Google would face if a court were to find that it unnecessarily violated privacy laws by turning those records over to the feds?

What About China?

Well, what about China? Google is breaking no laws there. I would rather that the firm be in that market than out of that market. To paraphrase a recent report, China's online population of 110 million has grown 18% in the last year, while the market for search ads has grown by 88%.

I think the stock is headed to $475, the highs last seen in January 2006.

Position: No positions