Diversity Investing News

Unleashing the Power of Sustainable Investments. Discover New Frontiers for Responsible Growth.

Black Lives Matter Corporate Pledges. Black Lives Matter Corporate Pledges, a website sponsored by Creative Investment Research that tracks foundation and corporate Black Lives Matter movement donations.

Updated Information On Corporate and Foundation Donations to Black Lives Matter. Black Lives Matter Corporate Pledges, (BlackLivesMatterCorporatePledges.com) a website sponsored by Creative Investment Research that tracks foundation and corporate Black Lives Matter movement donations.

Diversity & Inclusion Investment Virtual Forum. Wed, June 29, 2022. 11:00 AM - 1:30 PM EDT. Online event. CFA Institute DEI Code (USA & Canada). Sarah Maynard, Global Head, External DEI, CFA Institute.

FEDERAL AGENCY EQUITY ACTION PLANS: Executive Order on Advancing Racial Equity. Amazon Kindle. May 10, 2022.

Creative Investment Research Requests Federal Agencies Hold Corporations Accountable for BLM Pledges. PR Log. March 31, 2022.

Creative Investment a Signatory to New Diversity, Equity, and Inclusion Code. PR Log. March 22, 2022.

"Thriving As a Minority-Owned Business in Corporate America: Building a Pathway to Success for Minority Entrepreneurs." Springer Apress Books. Jan. 7, 2022.

Corporate Donations to Black Lives Matter Total $67 Billion. PR Log. Jun 24, 2021.

"How Investors Are Addressing Racial Injustice" The New York Times. July 3, 2020.

"Find Value By Investing In Diversity." Seeking Alpha. Jun. 7, 2020 8:02 PM.

"Positive performance: How impact investing boosts returns" Private Equity Wire. BY JAMES WILLIAMS | 02/07/2020 - 1:28PM.

"Four hundred years ago this month (August, 2019), the first enslaved people from Africa arrived in the Virginia colony. To observe the anniversary of American slavery, The New York Times Magazine launched the 1619 Project to examine the legacy of slavery in the U.S."

2019 CalPERS & CalSTRS Diversity Forum. The goal of the Diversity Forum is to bring together investment and corporate executives to discuss how to better capitalize on the abilities of the diverse modern workforce. This event is co-hosted by the California Public Employees' Retirement System (CalPERS) and California State Teachers' Retirement System (CalSTRS). See: 2019 CalPERS & CalSTRS Diversity Forum

Diversity and Inclusion in the Workplace After Trump ElectionThe election of Donald Trump resulted in highly visible expressions of concern and tensions among a number of specific groups of the U.S. population, leading to questions about the possible impact on issues of worry and inclusion in the workplace. To help answer these questions, Gallup asked workers nationwide a series of questions about inclusion and worry. Given the U.S. media discussion about diversity issues, Gallup was also interested in measuring whether companies had been communicating with their employees about diversity and inclusion issues. Diversity and Inclusion in the Workplace After Trump Election

CalPERS Announces Outreach Workshop for Emerging Manager Programs. The California Public Employees' Retirement System (CalPERS) announced that they will host a workshop on December 3, 2012 for emerging managers seeking to become investment partners with the Pension Fund. See: Outreach Workshop

Bank Nurtures Asian Roots. OCTOBER 10, 2011 The Wall Street Journal. East West, based in Pasadena, Calif., pays close attention to Asia. It seeks Chinese-American clients and attracts U.S. companies that do business in China. It also finances Chinese companies' expansion in the U.S. through trade finance and commercial loans.

Why Does the Fed Have So Little Supplier Diversity? Interview on DiversityInc.com website by Barbara Frankel on Jul 12, 2011 concerning supplier diversity at the Federal Reserve Board. See: https://twisri.blogspot.com/2011/07/why-does-fed-have-so-little-supplier.html

August 30, 2011 - President Obama signs Executive Order Establishing a Coordinated Government-wide Initiative to Promote Diversity and Inclusion in the Federal Workforce. See: https://twisri.blogspot.com/2011/08/executive-order-establishing.html

New Law Helps Minority and Women Contractors Land Big Deals. President Obama signs bill that gives our financial services firms a seat at the table. But is it enough? See: http://www.thehabarinetwork.com/new-law-helps-minority-and-women-contractors-land-big-deals

A May 16, 2011 article in the Washington Post Capital Business [Online at: "Federal Reserve Bank seeks diversity in contractor pool." discussed efforts by the Federal Reserve Bank of Richmond to increase contracting with women- and minority-owned firms.

3/7/11 - Pursuant to Request for Proposal No. 2010-5646, the California Public Employees' Retirement System intends to award the contract for Investment Diversity Consultant Services Spring-Fed Pool to Creative Investment Research, Inc. Contracts are of no force or effect until approved by the authorized officials. Contractors may not commence performance until such approval has been obtained. POST: March 7, 2011 through March 14, 2011. AWARD DATE: March 15, 2011

10/16/10 - Section 342 of the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act contains a significant provision creating an Office of Minority and Women Inclusion at various agencies to monitor the diversity efforts of the agencies, the regulated entities and agency contractors. The Section requires the Department of the Treasury, the Federal Deposit Insurance Corporation, the Federal Housing Finance Agency, each of the Federal Reserve Banks, the Board of Governors of the Federal Reserve System, the National Credit Union Administration, the Office of the Comptroller of the Currency, the Securities and Exchange Commission and Bureau of Consumer Financial Protection to create an Office of Minority and Women Inclusion to be responsible for all agency matters relating to diversity in management, employment and business activities. Details on Section 342 can be found at This Week in SRI Blog

First Socially Responsible Investing Portfolio Devoted to Diversity Launched. by Bill Baue. SocialFunds.com July 31, 2006. Online at: Diversity Fund Articles.

2/1/06 Emerging Manager Monthly (EMM) launched by Financial Investment News. EMM focuses of money management firms owned by women and minorities.

1/31/06 - The California Public Employees' Retirement System (CalPERS) and the California State Teachers' Retirement System (CalSTRS) announced the Expanding Investment Opportunities Through Diversity Conference, to be held on April 24 - 25, 2006 in San Jose, CA.

1/27/06 A study on diversity at boards of directors from Chicago United examined all of the firms in the Fortune 100. Chicago United concluded that:

For more, see Four Winners and Four Losers in Corporate Diversity

11/14/05 The Wall Street Journal runs an entire section titled The New Diversity. Corporations are moving from an assimilation model to an integration model to create a truly diverse culture and boost innovation and productivity.

11/3/05 - The Chartered Financial Analyst (CFA) Institute announces Diversity debate.

11/1/05 - The NY Times runs an advertising section devoted to Corporate Social Responsibility. Starbucks, Mattel, Nike, and other firms emphasize supplier diversity.

10/30/05 - The NY Times devotes an ad section to diversity, and it is sponsored by participating corporate advertisers.

8/3/05 Special CALSTRS Diversity Investing Initiative announced: The trend of rapidly growing ethnic communities continues, not only in California, but across the U.S. This trend, identified by many and harnessed by few, creates an enormous opportunity that can translate into valuable and attractive products for the investment community. Jack Ehnes, chief executive officer of CalSTRS.

How Will SRI Screens Evolve? Minneapolis Tribune. By Lisa Lacy. Aug 18, 2006.

There's a new fund in the socially responsible universe that is homing in on diversity as its No. 1 selection criterion. While the extremely focused strategy and its future effectiveness are being met with mixed reviews, its very existence may speak to screens in the future.

The fund, the Diversity Index Portfolio from Creative Investment Research, intends to promote diversity and target women and minority investors.

There aren't many socially responsible funds that use a similarly narrow focus, observers say, but the Diversity Index Portfolio isn't entirely alone. The Women's Equity Fund, which launched in 1993, invests in companies that advance the social and economic status of women in the workplace.

"The reason we started in the first place was to use the power of shareholders and their right to have a dialogue with the company to break the glass ceiling," says Linda Pei, president of Women's Equity.

The fund screens company stocks to make sure there is an adequate number of women on the board and in senior management. It also screens to make sure women are paid equally and that the employer offers benefits such as child care.

After 13 years, the fund has more than $35 million under management without doing much in the way of advertising.

But Pei had to start from the ground up, using the fund to attract clients one at a time rather than starting out with an existing client base. An overwhelming 90% of the shareholders today are women.

And Pei sees big potential. "If all working women understood why we have this fund and how powerful our message is, the fund could easily be $1 billion or more," she says. "I also know from listening to those who finally find us and invest in the fund. Their passion confirms my belief."

Passion is certainly a core element in socially responsible investing and has been since the beginning.

But not everyone agrees that the screens have seen major changes. For his part, Lipper senior research analyst Jeff Tjornehoj feels screens have largely remained the same over the years.

Anita Green, vice president of social research at the $2.2 billion Pax World Funds, says both diversity and the environment have been important screens for the firm's SRI funds from the very beginning. Interestingly enough, Green says Pax has found advocacy, or trying to invoke change at a company it invests in, more effective than trying to find firms that are socially conscious from the beginning.

Bill Cunningham, CEO of Creative Investment Research, expects to see more fully developed screens and funds in the future. "The market sees the need for additional investing styles and screens," he adds.

Part of the reason for growth in the SRI industry is investor demand. And growth is also an important factor in the launching of new funds. Because it is an industry that has reached a certain level of maturity, there are new providers that are trying to carve out their own niche where they can dominate, such as the Women's Equity Fund.

The question is whether there are enough investors for these focused funds. Many, including Schueth, argue that most socially conscious investors care about more than one issue and might not be attracted to a fund that stakes its claim solely on diversity.

However, pointing to Pei, Social Investment Forum president Tim Smith says the very fact that the Women's Equity Fund has existed for so many years using similar criteria bodes well for Cunningham, and that he can have "a profitable fund as well as a fund that's responsive to social issues."

Not everyone is so optimistic. Lipper's Tjornehoj says the Women's Equity Fund "hasn't developed into a name brand." Furthermore, he says sometimes it's an uphill battle to convince people that a particular brand of socially conscious investing is better than another because they're essentially cannibalizing other socially responsible funds.

Detractors also say most socially responsible funds already use diversity as one of many screens.

Tjornehoj expects the Diversity Index Portfolio to have some trouble attracting assets unless there's initial backing for an expensive marketing campaign or it has been tied in with a sponsorship deal with a progressive group.

The problem is that "diversity is not necessarily an investment strategy - it's a value," Tjornehoj says. Perhaps these funds are just a bit before their time.

Investors who are attracted to these very specific funds "and socially responsible investors as a whole, for that matter, tend to be very loyal as their investments are tied to beliefs, and so their money tends to be sticky," Tjornehoj says.

Smith notes that such funds market to a very specific clientele and have the added bonus of finding companies that are innately good rather than merely weeding out the bad ones.

In the early days, "it was all about avoiding the bad guys. Today it's far more about finding the best companies because the avoidance stuff is really easy."

StarTribune.com

INDEX OPENS NEW FRONT IN ETHICAL INVESTING

A portfolio of stocks based on a company's diversity was created last month in Minneapolis. No Minnesota firm is in it.

Kara McGuire, Star Tribune

There are investment portfolios that shun tobacco and alcohol companies and portfolios that appeal to different religious groups.

Why not one that makes choices based on a company's diversity practices, thought Bill Cunningham, an investment adviser and CEO of Creative Investment Research Inc. So he created the Diversity Index Portfolio last month from his office in Minneapolis' Uptown.

The portfolio, for which he will make buy, sell and rebalancing decisions only once a year, consists of 40 to 50 stocks, including the likes of Coca-Cola, Wells Fargo, Federated Department Stores, Time Warner, even Ford. Not a single Minnesota company is on the list.

Cunningham, the sole adviser, picks companies based on the number of racially diverse, gay, lesbian, transgendered, female or disabled employees and board members; senior management's commitment to diversity through policies such as domestic partner benefits and whether they communicate those policies to the public, and the volume of business a company does with diverse suppliers.

He also factors in basic financial fundamentals so a company with great diversity practices and awful performance won't make the cut.

Part of the reason for a lack of Minnesota companies in the portfolio is size. The portfolio tracks large-cap companies, defined as those with more than $10 billion in market value. Except for companies in the league of Target and UnitedHealth Group, the majority of Minnesota-based companies are too small.

But the omission also speaks to the need for the state to attract a more diverse population and to reduce the income and education gap between the racial groups that live here today, Cunningham said.

"If there's one company that's likely to be in future portfolios it's probably Target," he said, although to date he feels it has underperformed compared with others in its industry. He omitted UnitedHealth Group largely because of its corporate governance practices. And General Mills, an award-winner for its diversity efforts, lost to Kraft Foods. "[Kraft] just does a better job getting the message [about diversity] out there," he said.

For Minnesota companies to make the grade, Cunningham wants to see more diversity awareness training, mentoring and multicultural marketing.

Investing with heart

The number of socially responsible investment choices almost quadrupled in the past decade, from 55 mutual funds in 1995 to 201 last year, according to the Social Investment Forum's 2005 Trends Report.

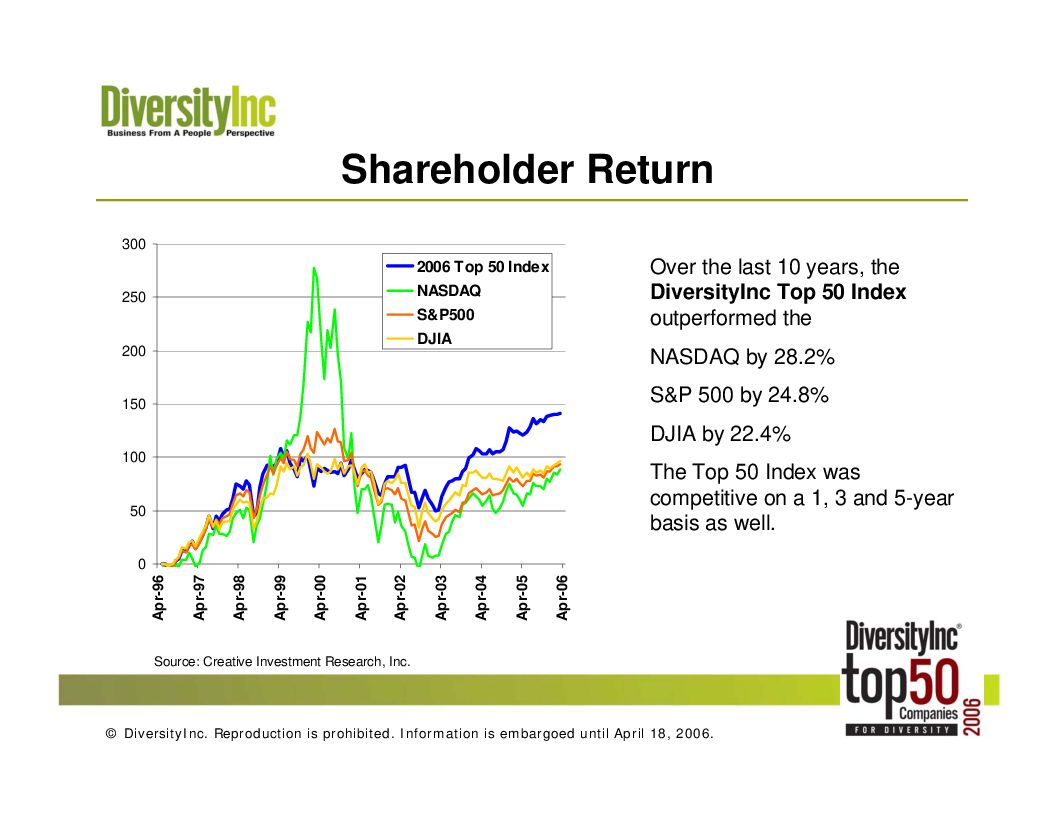

Values-guided investment doesn't mean sacrificing return. Cunningham's index would have beaten the Standard & Poor's 500 index of large-company stocks over the one-year period ended Sept. 13, returning 17.63 percent vs. the S&P 500's 9.46 percent. Cunningham believes that companies sensitive to diversity will outperform competitors that are less so, because employees will be less likely to leave and more likely to be innovative in an environment where they feel included.

Cunningham hopes the portfolio will grow to $1 billion in five years and will attract pension plans, 401(k) providers and individual investors. But while the portfolio is ready to accept money, no one has invested, not even Cunningham.

He blames inertia, not a lack of confidence, and plans to transfer money from other assets in the next couple of months. Personally, I prefer investments with a manager who has some skin in the game.

An Ohio-based supermarket company and two Illinois-based pension funds are considering the portfolio, he said.

The hesitation may stem from Cunningham's nonexistent track record managing a stock portfolio. His background is in financial research, consulting and managing mortgage backed securities for pension funds.

Can go it alone, with time

Individuals could substitute the Diversity Index Portfolio for a broader index of large-company stocks such as the S&P 500, although it's heavier on financial, automotive, consumer discretionary and utility stocks and lighter on technology and oil companies. It also wouldn't be too difficult to create a diversity portfolio of one's own using diversity stock lists published by magazines such as Diversity Inc. and Hispanic Business, although you'd have to have a lot of time for analysis and a lot of money lying around to buy shares of 50 stocks.

Unlike investors in mutual funds, investors in Cunningham's portfolio, which he manages online using a service called Foliofn (www.foliofn.com), own shares of stocks directly. The platform costs a fraction of a traditional brokerage, keeping the portfolio's expenses to 0.80 percent of the fund's assets plus a $25 annual account fee.

Direct shareholders can voice their opinions about company practices at shareholder meetings or through proxy voting. Mutual fund investors can vote on fund matters but not on matters of the companies held in the fund.He thinks a portfolio that allows investors to get more involved and incite change within corporate America will appeal to Minnesotans, who he said have a history of "community sensitivity and social responsibility." Cunningham also hopes the portfolio will do well with women, people of color and others who are likely to have experienced insensitivity and discrimination at work and would want to invest in companies committed to preventing such experiences from happening within their walls.

Kara McGuire writes about personal finance. Send ideas to kara@startribune.com or call 612-673-7293. Read Kara's blog: www.startribune.com/kablog.

Copyright, 2006 Star Tribune. All rights reserved.

Pax May Bless Some 'Sin' Stocks

The Wall Street Journal - FUND TRACK. By DIYA GULLAPALLI, September 1, 2006; Page C1

Maybe sin isn't quite as bad as it sounds.

That is what Pax World Funds, one of the biggest of the "socially responsible" mutual-fund families, has decided. In a few weeks, the company will hold a shareholder meeting where it will take action on the most significant change to its investment practices since it was launched about 35 years ago.

Socially responsible investing, or SRI, generally involves avoiding so-called sin stocks -- for instance, breweries, casinos and weapons makers. Pax was one of the first to give this strategy a try, and has maintained its approach since its founding by two Methodist ministers in Portsmouth, N.H.

Now, Pax wants to tone down that objective. Shareholders in August were sent a proxy statement to vote on whether to eliminate a zero-tolerance policy specifically against alcohol and gambling. The change would enable Pax to selectively invest in these industries based on a company's "entire social-responsibility profile."

But in other areas, the fund is trying to add new ways to screen out companies it might disapprove of. Shareholders will also vote on whether fund managers should consider a company's record on environmental issues, for instance.

These shifts illustrate how SRI funds are trying to tweak their strategies amid sagging returns. SRI investors are sometimes willing to exchange a few points of returns for socially conscious stock picking.

But many SRI funds have faltered because they tend to focus on "large growth" stocks, or big companies that offer fast-climbing earnings, an area that has done poorly in recent years. Large-growth funds have returned about 1% in the past year, but large-growth SRI funds have returned just 0.21% for the 12 months through July. Pax World Balanced Fund has returned only 4% in the 12 months through July, trailing more than half its peers.

By contrast, funds like Vice Fund -- which actively seeks out sin stocks -- have handily beaten most SRI funds recently. In the past three years, Vice Fund has posted a 20% average annual return.

A host of other SRI funds are also fiddling with their approaches. In December, Domini Social Investments LLC will abandon its traditional approach of passively tracking an index of socially responsible companies in its Domini Social Equity Fund, and instead will become an actively managed fund, picking its own stocks to invest in. Last year, it launched a new fund, Domini European Social Equity Fund, which was actively managed from the start. In May TIAA-CREF, the teacher's-pension giant, announced the formation of a new social and community investing department, and Ariel Capital Management LLC started Ariel Focus Fund last year.

In recent months, a slew of new SRI funds have cropped up that reflect this changing landscape. Parnassus Workplace Fund started last year to focus on companies that treat employees well, and minority-owned Creative Investment Research in Minneapolis launched the Diversity Index Portfolio this summer that uses employee diversity as a selection criterion.

Even exchange-traded funds, which trade on exchanges like stocks, are getting in on the do-gooder action. Barclays Global Investors has an SRI ETF and filed with regulators in August to launch another, iShares KLD 400 Social Index Fund, which would track a popular SRI index.

For Pax, the move comes after it had to sell a lucrative stake in Starbucks Corp. last year when the company set up a deal to launch a coffee liqueur with whiskey maker Jim Beam. The funds' 375,000 shares were valued at $23.4 million at the time, and had to be relinquished even though some SRI researchers estimate liquor-related sales contributed less than 1% to Starbucks's revenue. Similarly, Pax sold its stake in Yahoo Inc. last year after discovering that company had business ties to Internet gambling.

"I thought these were absurd results," says Joe Keefe, Pax's chief executive, who took that job last year. Mr. Keefe says he voiced this opinion during his interview for the job, and has been reading competitors' prospectuses to decide the best way to change the wording of Pax's own mandate.

SRI experts think dropping the ban on alcohol and gambling makes sense for Pax, because it will still try to avoid companies that derive substantial revenue from these areas. The company saw its biggest inflows in its history last year, roughly doubling its assets to more than $2 billion across its funds, and it is continuing to expand.

On Tuesday, Citizens Funds, another SRI fund company in Portsmouth, disclosed in a filing that it has signed a nonbinding letter of intent for Pax to buy its funds, which have about $800 million in assets. Terms weren't disclosed.

"I think it makes sense what they're doing," says Bill Rocco, an analyst who helps cover SRI funds for Morningstar Inc., the fund-research company. Some of his family members own Pax World Balanced Fund, he says, but "I also drink beer in moderation."

Jay Falk, president of SRI World Group Inc., a research company, agrees. "A screen on alcohol is a bit puritanical," he says.

The Pax funds are also taking steps to focus more on the corporate governance of the companies they invest in, such as whether the board of a company is sufficiently independent from management.

Separately, the Securities and Exchange Commission has been inquiring into issues related to the financial reporting at Pax's high-yield funds for more than a year. The SEC is also looking at potential conflicts of interest, given that the family of Pax's chairman owns Pax World Management Corp. and part of Pax's distribution company. Mr. Keefe declined to comment about the SEC inquiry.

Other SRI funds say they won't change their own sin-stock mandates just yet, with each varying slightly in guidelines like numerical cutoffs. Domini generally doesn't invest in companies that derive more than 1% of sales from alcohol production or more than 15% from alcohol retailing. Sometimes it can be even stricter than that. Domini decided not to buy toy maker Hasbro Inc. a few years ago despite the fact it made less than 1% of its money from licensing its Monopoly brand name to casino slot machines. Domini concluded it was inappropriate to use a children's game for gambling purposes.

For now, alcohol and gambling is "a place where Domini is not going to change," says Jeffrey MacDonagh, an SRI portfolio manager at Domini.

Ariel Capital Management, another large SRI fund company, doesn't screen for alcohol or gambling but does avoid tobacco and weapons companies. Unlike Domini, this has allowed the Ariel Fund to hold Hasbro among its 40 or so stock positions. Another SRI fund group, the Calvert Funds, won't invest in companies that derive more than 20% of revenue from selling or distributing alcohol, or 10% from weapons sales.

Still, such funds have changed other screens in recent years. Ariel added a screen against handguns in 2003, and Calvert added one about preserving the rights of indigenous people in 1999. Others have added more contemporary factors like nondiscrimination based on sexual orientation.

Copyright 2006 Dow Jones & Company, Inc. All Rights Reserved.